Full service payroll

for enterprises

Free up time to focus on strategy. Let us tackle payroll details — big or small.

Already using ADP? Sign in or get support.

Ready to upgrade your HR suite?

See for yourself what ADP Workforce Now® can do for you.

2-minute overview

See how our single, scalable HR suite is designed to help your workforce thrive.

Experience the benefits of working with ADP.

When you work with our payroll experts, you get tailored solutions that fit your organization’s needs — saving you time and money while giving you the support you need to excel in your business.

Tailored to meet your needs

Every business is different, and not every business owner has the time or expertise to run payroll. ADP’s payroll solutions are easy to use and run. We also offer more options than any other provider globally. With over 70 years of payroll-processing experience globally, ADP has payroll solutions to support customers across:

- Size — From 50 employees to 1,000 employees to 100,000 employees, across the globe

- Industry — From hospitality to health care, manufacturing to construction, retail to financial services, tech and more

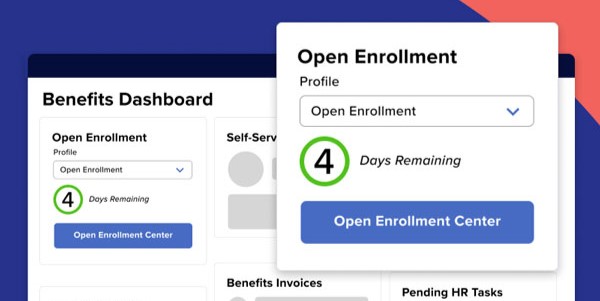

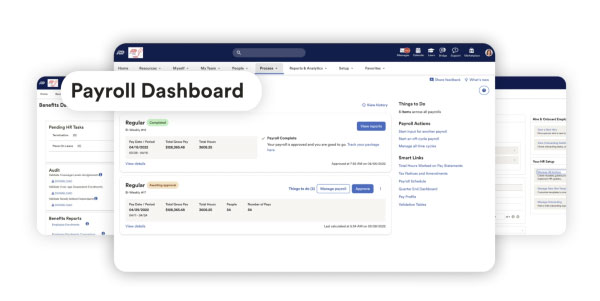

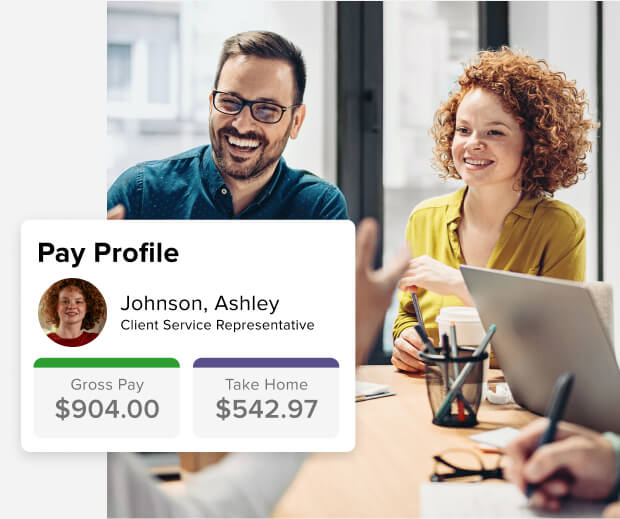

Easy to use

We listened to client feedback and ran with their design ideas to make our payroll platforms intuitive. Having employee compensation and benefits in one place makes it easy to decide how you can do more for your team. Additionally, it can help mitigate the risk of making mistakes – saving you time and money.

What you need, all in one place

When payroll and HR systems are unified, you can log in to one system for all your HR management needs:

- With one click, add a new employee with data pulled directly from your applicant-tracking system

- When an employee changes benefits, the revised deduction automatically pulls through to your payroll

- One HR database lets you access the metrics and reporting you need to manage your workforce

“I really enjoy ADP Workforce Now Comprehensive Services with its fully outsourced HR shared service. It’s done very well for the company and there’s more to the product that we haven’t tapped yet — we’ll get there eventually. I also like that there are ongoing plans for product enhancements – this is important to my business partners. It’s been a great program. I look forward to continuing to work with the ADP team.”

—Terry Sugar, VP of Finance

Farmbro Inc.

Proven savings

How much can you save when you partner with us for payroll? According to Forrester’s recent Total Economic Impact study, our ADP Workforce Now clients saved up to $797K over three years.

Buy only what you need

Choose the right option for your business and pay only for what you need.

Relentlessly focused on making payroll easier

We’re committed to your business’s future. Our team of researchers and business anthropologists listen to clients like you to understand how we can best fit your needs. Our full service payroll makes it easy to run payroll – whether it’s paying employees different pay rates or dealing with payroll tax forms, we will have you covered.

We’ve got your back for compliance and more

Rest easier, knowing that your payroll is always accurate, on time and in compliance. Our compliance and support specialists stay on top of regulations so you don’t have to. You’ll know you’re in compliance with local and global payroll and tax regulations, tax reform, overtime rules, and more.

Trusted by more businesses than any other payroll provider

ADP globally works with more than 1,000,000 clients worldwide — and most partner with ADP for 10 years or more. That says something about commitment and trust. ADP stays up to date with current legislation, making it easier for your business to remain compliant without having to become an HR or payroll specialist. Our comprehensive services offers give you access to our experts who can help you every step of the way.

“With multiple offices and a growing number of employees, managing time and attendance was a big area of concern for us, as we were doing it manually. Even tracking sick days was taking up a huge portion of our staff’s time. The ADP Workforce Now Comprehensive Services solution has saved us time, and freed up team members to focus on other parts of the business.”

— Sylvie Gill, Director

Health Sciences Association of Alberta (HSAA)

Professional support from certified payroll practitioners

With responsive, certified payroll practitioners to lean on, you always get the level of support you need — from getting your payroll up and running to handling all your payroll-related questions. There are a number of options to contact us, including email, phone, or chat.

Hands-on implementation support

Depending on your needs and the best payroll solution for your business, you can get personalized, one-on-one implementation training by an ADP expert, not a third-party vendor. You also get it when you need it, using your own configuration and data — not dummy data or a demo system — so you can get up to speed quickly and easily.

MEET OUR CLIENTS

The implementation and training processes were seamless. In addition to a 50 percent savings from my previous payroll provider, I’ve found ADP’s customer service to be a massive upgrade.

Nilmini Fernando Finance Manager, NE Seal

MEET OUR CLIENTS

We were up and running within 48 hours after we made first contact.

Zack Tavakoli Director of Operations, Technomed

MEET OUR CLIENTS

There’s always somebody from ADP who is quick to answer and help; I’m grateful to be able to get my questions answered right away.

Lisa Fiorotto-Bickert Owner and CEO, Deuce Tattoos

Awards and recognition

Frequently asked questions

What is full-service payroll?

Full-service payroll providers are comprehensive companies that offer businesses the option to outsource their payroll activities. By engaging one of these firms, businesses can offload tasks such as payroll processing, issuing cheques and direct deposits, as well as managing tax filing and payments.

What is a fully managed payroll service?

In a fully managed payroll arrangement, the payroll vendor assumes the entire responsibility for handling every aspect of the payroll process, from data entry to tax filings. On the other hand, in a partially managed payroll setup, the vendor is only responsible for certain aspects of payroll, such as processing, while the internal team retains control over other critical payroll functions.

Is ADP Canada an enterprise software?

ADP Canada is an optimal human capital management (HCM) solution specifically designed for large-scale enterprises with a workforce of over 1000 employees, spanning various sectors. What sets ADP Canada apart is its dual offering: the ease and efficiency of outsourced software, combined with unparalleled customization options, which are also bilingual. This solution empowers businesses with deep, actionable insights and robust analytics, while also ensuring seamless integration across an extensive variety of products.

I’m switching from another payroll provider. Can I transfer my data?

Our team of specialists will work closely with you to ensure the accurate transfer of your data when you opt for ADP’s services.

How do I pay multistate payroll taxes?

With ADP Canada’s online full service payroll services, you have the flexibility to manage payroll for employees across various locations, including those working remotely or from their homes. Leave the complex task of calculating taxes to us, as our system is designed to handle these intricacies seamlessly.

What is included in ADP’s full service payroll?

Our full service payroll software simplifies the entire payroll process from beginning to end. It includes processing recurring payroll with real-time calculations, built-in reports for payroll reporting, payroll audit, year-end balancing and reconciliation, online pay and tax statements, payroll compliance, payroll alerts and tips, service metrics and analytics, and more.

Does ADP’s full service payroll handle 3rd party remittances and garnishments?

Yes, ADP’s full service payroll handles 3rd party remittances and garnishments

What is needed to process your payroll?

Here is a list of what is needed from employees to process payroll accurately:

- Full name

- Date of birth

- Current address in Canada

- Social insurance number (SIN)

- Hire start date

- Pay type: salaried or hourly

- Amounts to be paid (including salary/wages and any bonuses)

Articles & Insights

guidebook

Tips for Evaluating New Payroll and HR Providers

guidebook

Smooth and Easy Payroll Implementation Services

insight

What does global payroll processing entail?

A single solution for payroll & HR

Let’s find the perfect solution for your business.

Call 866-622-8153 or complete the form below:

Your privacy is assured.

Pay

Pay

Payroll Taxes

Payroll Taxes

Reports

Reports

Self Service

Self Service

Software Integration

Software Integration

Outsourcing

Outsourcing