Payroll Software that’s easy and affordable

Running payroll is one of the most important aspects of any successful business, but that doesn’t mean it has to be stressful. With first-class payroll software, you’ll experience peace of mind knowing you have the resources to pay your employees and taxes correctly and on time.

Our payroll management solutions will help you simplify your payroll and ensure compliance with local regulations.

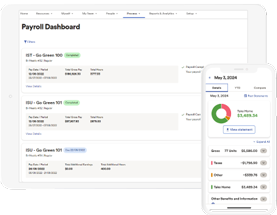

ADP’s payroll software features:

24/7 access from any device

A user-friendly interface

Automated features

Expert service and support in English and French

Payroll Software Features and Benefits

In the cloud – and beyond

Discover how ADP’s online payroll software can help you improve your business operations.

Automated systems and reports save time and help to reduce errors

Processing payroll is simple with ADP. Our payroll systems automate labour intensive tasks, such as:

- Calculations

- Tax withholdings

- Paper cheques

- Digital payments

In addition, you can store all your employees’ information in our web-based interface. This drastically reduces the mistakes that can happen when entering data on a repeat basis.

A payroll system for seamless integration

ADP’s payroll software easily syncs with time and attendance solutions and other human resource programs. So, from one place, you can manage not just payroll, but also benefits, employee absences, RRSP contributions, and more.

Federal, provincial and local compliance

Avoid missing another filing with the government. Our payroll software helps you keep your paperwork up-to-date and submitted on time. It also provides easy access to mandatory forms, such as T4s and Relevés, and notifies you about changes to minimum wage, tax codes and other regulations. On top of that, having operated in the province of Quebec for over 40 years, ADP Canada has significant expertise in creating and supporting French workplaces.

Support

When payroll issues arise, you need the right solution fast. ADP’s certified and experienced professionals can assist with your payroll software needs.

Payroll processing software for any size business

For 1—49 Employees

With this easy to use payroll and time solution, you can hire, add earnings and deductions, manage time and pay your employees.

For 50—10,000+ Employees

All-in-one platform for payroll, HR, talent management, and time with expert support and analytics for data-driven insights

Payroll software FAQs

What is payroll software?

Payroll software allows you to handle your employees' payroll, ensuring that you comply with federal and provincial payroll regulations. Typically, a payroll system will enable direct deposits to your employees' bank accounts from a linked account, while also producing T4 slips for tax season and computing income tax, CPP deductions, EI remittances, and other deductions that you may be responsible for remitting to the government.

The top payroll software for small businesses in Canada also incorporates HR functionalities such as recruitment, onboarding, the ability for employees to request time off, management of group benefits, and other features that may be beneficial to small business owners without dedicated HR personnel.

How is a payroll software program used?

The way your team uses an online payroll management system can differ based on your team's size, your employees' skill levels, and the specific system employed. Typically, these services offer sales and customer support representatives who can assist with setup and address any queries throughout the process.

How to choose payroll software?

Here are some considerations when choosing payroll software:

- Essential features: Such as the user interface, for instance. This is important for both employers and employees, who may need access to self-service options. Many providers offer guided trials for potential customers, so you may take advantage of these before making a purchase.

- Software integrations: If you are currently using other software, you may prefer payroll software that can be integrated with your current tools.

- Budget. While there are many cost-effective options, the various fees can accumulate. Decide on your payroll software budget before selecting one with a multitude of features, as you may only need a few basic features that are available for a lower cost.

- Other important considerations: For example, does the payroll software provide tax services? A software solution that manages your filings can spare you significant time at the time of tax filing.

What are the best payroll solutions?

No two payroll providers are the same, but most high-quality solutions can:

- Automate labour-intensive payroll and tax calculations

- Deposit tax payments on time

- Assist with inquiries from the CRA, should they occur

- Help support compliance with constantly changing employment laws and regulations

- Integrate seamlessly with timekeeping, workers’ compensation, insurance services and other HR applications

- Provide support with unemployment claims

- Protect sensitive client payroll data

When can I begin using software for payroll?

With ADP, you can start processing payroll at any time, not just during a new quarter or new year. If you’re switching providers, you can transition easily by asking for all the necessary forms and information upfront.

What is the time commitment when processing payroll online?

Compared to manual data entry, payroll software can save you considerable time. The features available in the package you choose will determine your total work effort.

What if I’m already processing payroll with an accountant or bookkeeper?

Your accountant will probably appreciate that you’re using a trusted payroll service provider because it enables seamless data integration, reporting, and processing. This empowers accountants to do more work with greater efficiency, so they have more time to work on strategies that help you run a better business.

How much does payroll software cost?

Payroll software costs vary depending on the number of people employed by the business, its individual needs and the provider’s price structure. An annual base price usually applies and there may be an additional fee for each payroll transaction. When weighing payroll software costs, it can be important to assess the level of support provided with the product and how well it can integrate with other programs. At times, providers may have hidden costs; however, ADP ensures this isn’t the case.

In the event of a catastrophe or local emergency, how will workers get paid?

You can process payroll anywhere because ADP products are online. So, even if you’re relocated from your place of business, ADP’s payroll software lets you easily use a mobile device to pay your employees.

Why others choose ADP payroll software

MEET OUR CLIENTS

The fact that ADP Workforce Now is a bilingual solution is allowing us to stay compliant in the province of Quebec.

VP of People, food delivery, Quebec

MEET OUR CLIENTS

My experience has been great, the solution is really well organized and easy to use. My needs are simple; I have a total of 10 people who work for me in store and in the kitchens. ADP Workforce Now On the Go® allows me to keep track of their time and from there its straight forward to process payroll.

Mark Miller Owner, The Macaron Boutique

MEET OUR CLIENTS

I don’t know how you put a price on the time we spend on things like tracking down pay stubs or checking available holiday time. Over time they end up taking far longer than you would like. ADP Workforce Now® has freed up significant time and resources for our staff to focus on bigger and better things.

Faith Laframboise Manager of Human Resources, SPIROL Industries

Awards and recognition

Resources & Insights

insight

Payroll management system

insight

Outsourcing Payroll

insight

Switching Payroll Providers Made Easy

insight

2025 Payroll Calendar

guidebook

Tips for Evaluating New Payroll and HR Providers

Get Started

Let's find the perfect solution for your business.

Call 866-622-8153 or complete the form below:

Your privacy is assured.